For Financial Health, Consider an Information Diet

In today’s digital age, investors are drowning in unproductive information.

Market commentary and news flow often thrive at the extremes, drawing the attention of investors during periods of market exuberance or decline. When investors zoom in on this noise flow, they tend to make less rational and unprofitable decisions.

Unproductive attention

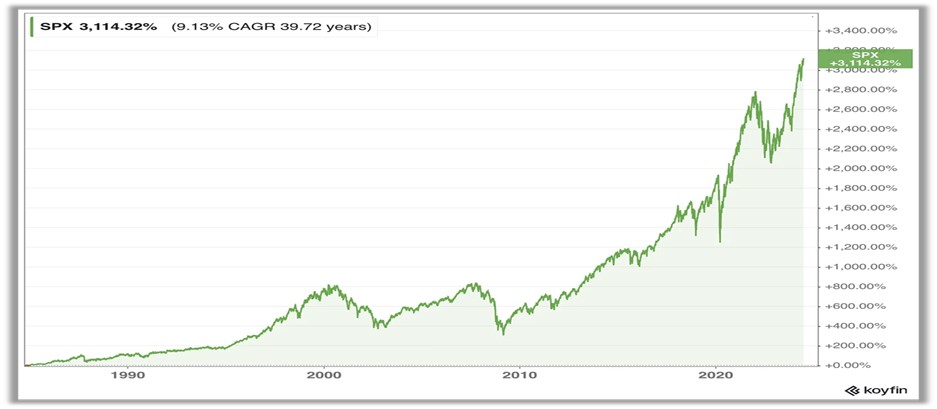

Over a 40-year period, the S&P 500 index has demonstrated impressive growth, compounding at approximately 9% annually and increasing by over 3000% in total. Over the long term we observe a clearly upward sloping trendline.

The trendline however does not accurately reflect the daily experience that an investor had to endure to earn that 9% average annual return.

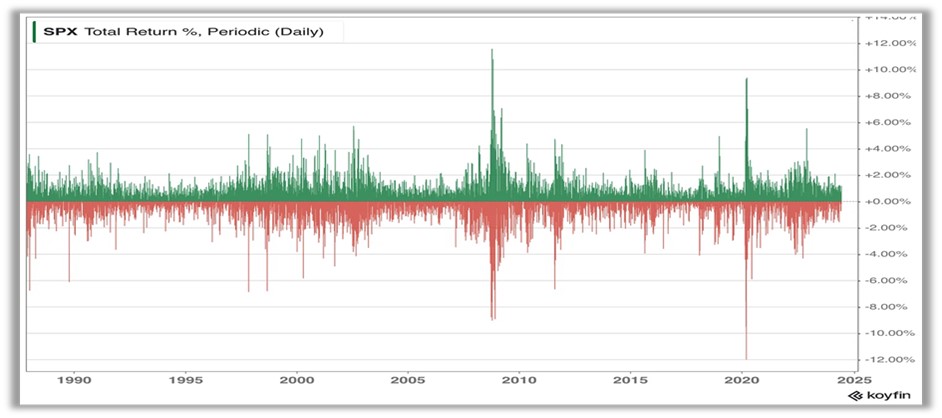

Investors that gave attention to the daily news flows would have had a very different experience. When we consider the same chart below, adjusted to show daily periodic returns for the index, it would be impossible to anticipate what the return over the full period would have been.

This chart reflects accurately the lived experience of the average investor. What is clear from the chart is that the market is volatile, and that significant gains and losses are often situated in close proximity.

Protect your Time and Attention

Checking your portfolio holdings regularly and giving attention to the daily noise flow amplifies your human biases and behavioural flaws that lead to poor decision making. During these periods more than 90% of the information investors consume and obsess over is a waste of time.

Following the daily economic and geopolitical news is nothing more than a distraction. This noise not only consumes your most precious resources, time and attention, but also primes you for action when inaction has proven to be the better option.

The path to financial health begins with recognizing the value of your time and attention and taking proactive steps to protect these resources from unproductive distractions.

By embracing an information diet and focusing on the fundamentals of investing, investors increase the odds of ultimately securing their long-term financial well-being.

The above article was written and adapted by Marius Kilian.

Source

*“How Often is Too Often?”, Conor Mac, investmenttalk.co, 9 Jun 24

*Charts, Koyfin.com