It’s the End of the World as We Know It

This past week in the markets was historic – for all the wrong reasons. It reminded me of the words from a popular R.E.M. song during my varsity days, which I’ve borrowed as the title of this article.

The now-familiar word “tariff” has caused markets to react with significant drawdowns. For many investors, these sharp drops trigger a deep, primal anxiety. Fear often compels us to take action – any action – to stop the perceived bleeding. This is reflected in panic selling during drawdowns.

In a recent blog, market strategist Charlie Bilello (Creative Planning) offers valuable perspective on the emotional rollercoaster of market downturns. He emphasizes how short-term discomfort can lead investors to make decisions that harm their long-term outcomes. His insights are a sobering reminder of how markets have historically recovered after similar turbulent periods.

Yes, This Has Been Painful

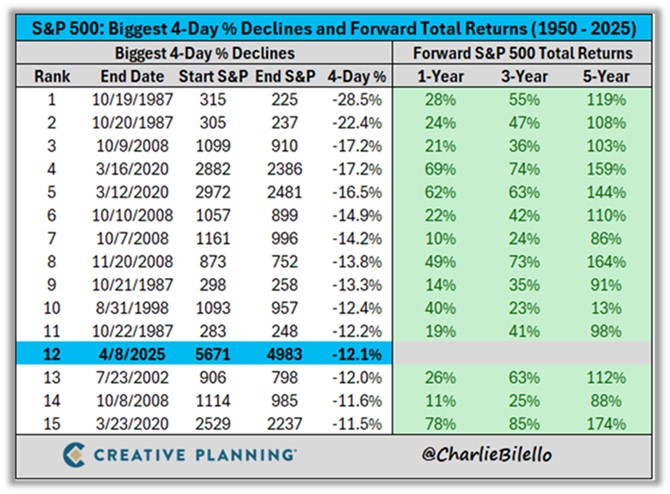

The S&P 500 officially entered bear market territory, with a peak-to-trough decline exceeding 21%. As of April 8, it was down 15.3% year-to-date – marking the fourth-worst start to a year in history. Over just four trading days, it lost 12.1%, making it one of the steepest short-term drops ever.

So, what has history shown us after such steep 4-day declines?

Every time, the market moved substantially higher over the next 1, 3, and 5 years.

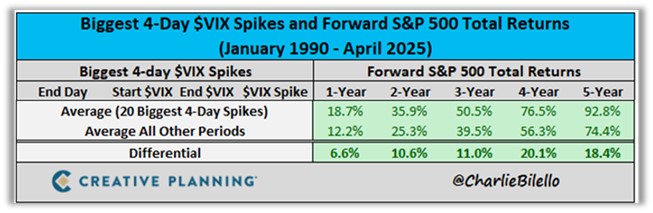

Meanwhile, the Volatility Index ($VIX) surged 143% over those same four days – the third-largest 4-day spike ever recorded.

And what has happened historically after such volatility spikes?

Again, stocks have rebounded with above-average returns over the following 1 to 5 years. In fact, the $VIX closed above 50 last Tuesday, placing it in the top 1% of all historical readings.

What has happened in the past following closes above 50?

Consistent gains in the S&P 500 over the next 1 to 5 years – every single time.

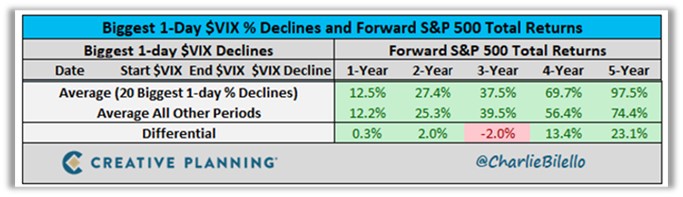

Then came a surprise: the day after Donald Trump’s new tariff announcement (which reduced rates for all but China), the S&P 500 jumped 9.5%. That marked the third-biggest one-day gain for the index since 1950.

What has followed such one-day spikes historically?

Markets moved significantly higher over the next 1, 3, and 5 years.

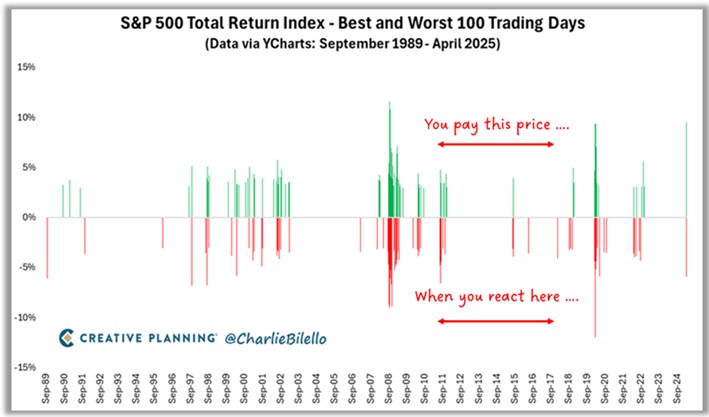

Volatility Comes in Waves

Both the biggest gains and the biggest losses tend to occur close together, underlining the idea that volatility clusters rather than spreads out evenly over time. Intense market activity—whether positive or negative—is usually followed by more turbulence, not calm.

For long-term investors, this reinforces a crucial point: missing just a few of the market’s best days can drastically alter your overall returns, as the most dramatic movements tend to happen in short bursts.

Staying invested during uncertainty is often the wiser course. The line between a steep decline and a sudden recovery is often razor-thin. History shows us that investors’ reactions to volatility often cause more long-term harm than the volatility itself.

Reflect on the Right Questions

In a recent blog post, Jesse Cramer encourages investors to pause and ask themselves some important questions. These aren’t meant to be prescriptive or patronizing but rather to promote reflection and clarity in times of chaos. Here are some worth considering:

- Did your goals change in the past week?

- Did your timelines change?

- What does your financial plan require you to do right now?

- Are your current decisions driven by evidence and analysis?

- What does “long-term” mean to you?

- What will happen if you do nothing at all right now?

- Are you chasing certainty in an uncertain world?

- Have you rewritten your personal investment philosophy?

So… What Now?

The truth is that the future remains uncertain. Market forecasts might feel reassuring in the short term, but they have historically led to costly mistakes. Now is often when people unknowingly dig themselves into holes that are hard to escape.

Can things get worse? Yes, they can. Is it the end of the world? It certainly feels like it – but it never is.

To borrow the famous words from R.E.M.’s 1987 hit:

“It’s the end of the world as we know it… and I feel fine.”

While it may feel like everything is falling apart, resilience and composure have always been the best allies for long-term investors.

Assuming you have a well-thought-out investment plan and strategy, the best behaviour right now may simply be – stay the course.

Based on the evidence of history… if you do… you should be fine.

The above article was written and adapted by Marius Kilian.

Sources

*“The Week in Charts (4/14/25)”, Charlie Bilello, bilello.blog, 14 Apr 2025

*“15 Questions for Scared Investors Right Now”, Jesse Cramer, bestinterest.blog, 9 Apr 2025

* “It’s the End of the World as We Know It (And I Feel Fine)”, R.E.M.’s apocalyptic hit of 1987