What if you could time recessions?

From 1871 the US market has provided an annualised real return of 6,9% despite the 30 recessions you had to endure.

That is the return if you stayed invested through all the ups and downs: buy-and-hold. But we don’t like the downs.

Let’s assume you could time recessions

We know that this cannot be done with any consistency. But if it was possible, what difference would it have made? Charlie Bilello answered this question in his recent article “How to think about investing during a recession.”

If you had full knowledge of when recessions would start and end in advance and moved your investments into cash during recessions and then back into the equities when markets expanded your annualised return would have been 10,6% versus 9,7% for a “buy-and hold” strategy (since 1928).

If you exclude the Great Depression (1929-1939) which accounted for the bulk of the losses, and you timed each recession perfectly, you would have underperformed with a 10,6% return versus 11,7% for buy-and-hold.

We know that perfect timing is an illusion. Nobody can predict the start and end of recessions. We only know we experienced a recession by looking back.

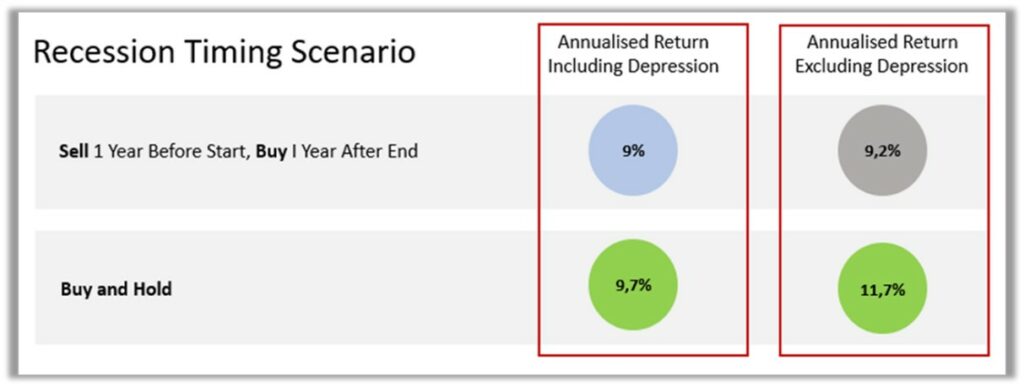

Let’s assume you moved into cash a year before every recession started and then back into equities a year after it ended. This would take incredible skill and luck to do, but even so, how would you have stacked up against a buy-and-hold discipline?

The data shows that a buy-and-hold discipline would have trumped every recession timing approach – as is evident in the graph below:

How can that be? It does not feel right.

It is simple. The market is not the economy.

The markets look ahead and discounts future expectations into current pricing. The market and economic growth do not move in lockstep. At times the market turns south whilst the economy is growing and vice versa. Markets move first.

We know from history that all recessions and bear markets end. Thereafter markets have always expanded to new highs at some point in the future. Long-term investors who stayed the course have historically been rewarded for their discipline and patience.

Your long-term portfolio is informed by your long-term objective. Your diversified portfolio has been structured to give you the best odds of achieving your required rate of return. It is important to understand that this is an investment portfolio and not a trading portfolio.

That’s why we are called “investors” and not “traders”. Traders are short-term focussed. They need to have a view on the next day, week, or month. Time makes the difference for the investor. Calling the economy and recessions have not rewarded investors, even when assuming it could be done with any consistency.

The late Jack Bogle, founder of Vanguard Group, once commented: “The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly 50 years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.”

Can things get worse before it gets better? Truthful answer – I don’t know. It is possible.

We have experienced two supply-side shocks: the Russian invasion and the Chinese COVID lock down. CPI seems to be peaking and general negativity is at a high. Counter intuitively, this has historically not been a good time to move out of risk assets.

The S&P 500 hit its year-to-date low on 17 June at -22,33% for the year. We then experienced a positive return of 16,85% from this low to 17 August. This represents a retracement of more than half of the losses in a very short period. The S&P 500 is currently down -9,44% year-to-date. The JSE All Share was down -10,33% year-to-date on 14 June. On 16 August it was only down -0,83 year-to-date recovering almost all the losses – again – in a very short period.

“But with the exception of the Great Recession, recessions have tended to be short and followed by robust recoveries. So, focus on your long-term goals rather than on short-term market gyrations. If you have a plan you believe in, stick with it. “– Fidelity Viewpoint

Is this market drawdown painful? Absolutely. History being my guide it would be better for me to check my behaviour than my portfolio.

“The most important thing for investors to do is to be invested” – Howard Marks

Resources;

* Charlie Belillo – ”How-to-think-about-investing-during-a-recession” – compoundadvisors.com

* What’s next for the economy? – Fidelity Viewpoints 8 August 22

The above article was written by Marius Kilian.